Contents

This is natural, traders get adjusted to their new patterns as they go. Generally, the familiarity of shares vs Forex is a myth, although it technically can be justified. But we don’t necessarily know all the details of what affects their exchange rate. Therefore, don’t think that just because one asset is riskier than the other, you’ll be safe with the less risky one.

Not every investor is approved for a margin account, which is what you need to leverage in the stock market. Gordon Scott has been an active investor and technical analyst of securities, futures, forex, and penny stocks for 20+ years. He is a member of the Investopedia Financial Review Board and the co-author of Investing to Win. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

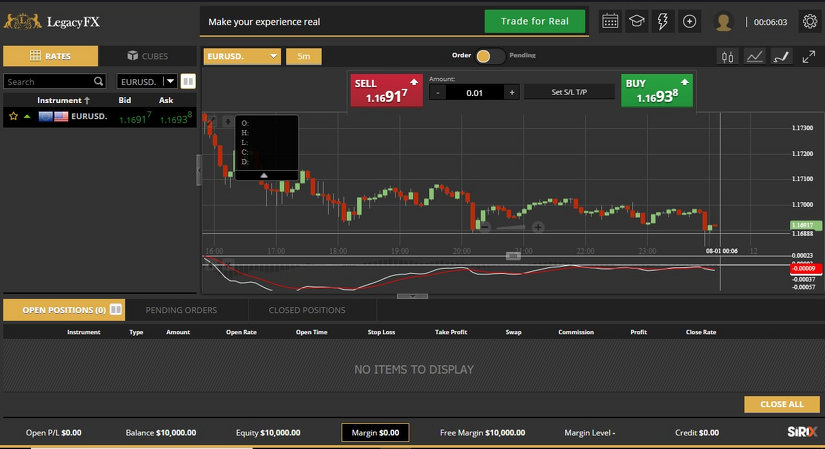

After all, you need the price of something to move significantly to make any profit buying and selling it. The easiest way to make money is by trading something where the price goes straight up or straight down, although of course it is rarely as straightforward as that. With stock CFDs, the interest charged is typically a little higher. If you are buying real stocks, you will not pay any overnight interest.

How can I earn 500 a day in share market?

- Take small profits and do multiple trades.

- Trade stocks in news. Learn the basics of Share Market with Stock Market Made Easy Course by Market Experts.

- Stop Loss discipline.

- Minimizing trading cost. Frequently Asked Questions.

When you buy Intel shares, your primary concern is whether the stock will increase in value; you’re less concerned with the stock prices of other companies. The only “pair” is between the stock price and the U.S. dollar (if you’re trading in the U.S.). In sharp contrast, forex trades of several hundred million dollars in a major currency will most likely have little—or no—impact on the currency’s market price. There is too much supply for any single transaction to have too much of an impact.

Both of these financial markets have their advantages and disadvantages, but that doesn’t mean that it’s hard to choose. Every stock exchange can be ranked based on how many large companies stocks it sells. This makes it a lot more centralized, simply because the current largest companies in the world are located in the USA. In order to compare Forex and stock trading, we need to look at both the fundamental and technical aspects of these two markets.

Or unless you are trading a huge fund with billions on your account. They have usually a good compromise between available leverage and account size. That’s what kills most people’s accounts that try to trade forex. This is very useful for day traders as it doesn’t require them to be available at a specific time and also allows them to expand their operations to different time frames, creating more trading opportunities. Many currencies have recently experienced a rollercoaster ride of movement. Understand that if you’re unable to meet a margin call, your position may be closed immediately and you might not be able to recover any of your initial investment.

This is the primary forex market where those currency pairs are swapped and exchange rates are determined in real-time, based on supply and demand. Stocks are shares of public listed companies which are traded on the stock exchange. A stock exchange is a marketplace where traders buy and sell stocks. Stock exchange provides a regulated and transparent platform to buyers and sellers for trading. Both stock and forex markets involve a range of risks, but forex is riskier due to the leverage involved and the number of factors that influence currencies.

Similarities between Forex and Stocks

No matter how we look at it, financial markets are a very hard thing to navigate, regardless of whether you’re trading Forex vs stocks, and usually result in a loss rather than a win. This gives traders the opportunity to generate more payouts with smaller deposits and is a very important difference between Forex and stock trading. A chance for larger payouts – this means that with Forex, traders usually have the opportunity to generate more with less.

We offer forex trading on more than 330 currency pairs, including major, minor and exotic forex pairs, which is the highest figure in the current market (see our forex trading page for more details). Forex traders tend to lean toward major currencies such as EUR/USD and GBP/USD, as these considered to be generally stable within the forex market. The forex market is open 24 hours a day, five days a week, which gives traders in this market the opportunity to react to news that might not affect the stock market until much later.

Forex vs Stocks: Which Is Better For Day Trading?

Investors who foresee a particular currency declining can easily sell that currency and buy another currency in return. Currencies can be exchanged anywhere over-the-counter and can be traded 24 hours a day, 5 days a week. The leverage is not giant like forex but it’s enough to trade without a big amount of capital. This is the way that you can use to choose what broker should you choose to trade regarding the commissions. During those overlap periods, the markets have an increase in volatility, which means they are good times to trade those markets. If you are trading Dow Jones or S&P500 or any other US index, then you should trade them when the New York session is open.

We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Like any other market, currency prices are set by the supply and demand of sellers and broke millennial review buyers. Demand for particular currencies can also be influenced by interest rates, central bank policy, the pace of economic growth and the political environment in the country in question. Foreign exchange trading—also commonly called forex trading or FX—is the global market for exchanging foreign currencies.

Do banks hire forex traders?

Institutional investors such as banks, multinational corporations, and central banks that need to hedge against foreign currency value fluctuations also hire forex traders.

Forex is what has the lowest volatility, so it’s the worse one to trade, especially short-term. Check this graph with the volatility of the most traded forex pair, EURUSD. The market that you choose to trade may have a high impact on your profitability. Since it’s the most traded market in the world, we are constantly being bombarded by forex advertisements. Closely monitor the national, regional and international news for your countries daily.

Forex Market Open Hours

The forex Market is a huge market with a daily volume of $6.6 trillion, according to the 2019 Triennial Survey of turnover in OTC FX markets. The worldwide 2021 forex market is worth $2,409,000,000 ($2.409 quadrillion). The 21st century is all about living globally, traveling, and being able to work remotely from anywhere in the world. Broker A charges $7 commission per 1 lot per trade (in + out).

Some research is recommended, of course, so that you might be able to tell if the new change is just a random fluctuation, or if it happens due to some major economic reason. That can help you understand if it is going to be corrected soon, or if it might lead to a bigger drop in the value of a currency. DEEP DIVE In December, we listed analysts’ favorite semiconductor stocks for 2022. But after chipmakers’ stocks have been hammered, the group is now trading at “normal-level valuations,” according to Matt Peron, director of research at Janus Henderson Investors. Today after the market closed, we issued a press release announcing our second quarter 2022 financial results. On this call to discuss the results are Jason Gorevic, chief executive officer; and Mala Murthy, chief financial officer.

Forex is traded by what’s known as a lot, or a standardized unit of currency. The typical lot size is 100,000 units of currency, though there are micro and mini lots available for trading, too. The exchange rate represents how much of the quote currency is needed to buy 1 unit of the base currency.

In the U.S. financial markets, major indexes include the Dow Jones Industrial Average , the Nasdaq Composite Index, the Standard & Poor’s 500 Index (S&P 500), and the Russell 2000. The indexes provide traders and investors with an important method of gauging the movement of the overall market. Diversify your portfolio – stock trading is the best way to diversify your portfolio.

Tax Treatment: Forex Vs Equities

She has expertise in finance, investing, real estate, and world history. Kirsten is also the founder and director of Your Best Edit; find her on LinkedIn and Facebook. Samantha Silberstein is a Certified Financial Planner, FINRA Series 7 and 63 profitable forex scalping strategy pdf licensed holder, State of California life, accident, and health insurance licensed agent, and CFA. She spends her days working with hundreds of employees from non-profit and higher education organizations on their personal financial plans.

Can I make a living trading stocks?

Key Takeaways. Trading is often viewed as a high barrier-to-entry profession, but as long as you have both ambition and patience, you can trade for a living (even with little to no money). Trading can become a full-time career opportunity, a part-time opportunity, or just a way to generate supplemental income.

Buy a share of Google stock and you literally own a piece of Google. Large companies will typically issue millions, if not billions, of shares of stock. A single share of stock in a company like this will mean that you own one-one billionth of the overall firm. Withforex, there are dozens of currencies traded, but the majority of market players trade the seven major pairs.

How much does trading cost?

A broker that doesn’t charge commissions typically has higher spreads. On the other hand, you know that brokers get money from the spread that you pay. Note that this screenshot was taken after the market close when the spreads are typically higher than during the day. On the other hand, brokers that charge commissions have lower spreads.

A small market movement can have an enormous impact upon the value of a forex portfolio. If an investor can’t meet the margin calls, their position is closed out. Unlike leveraging in stock trading, this closure comes without warning. In general, the stock market tends to be more volatile than the forex market since currencies tend to be relatively stable in price alexander elder biografia with respect to one another when economic conditions are steady. However, this is not always the case, and forex trading has a reputation for periods of extreme volatility – which may or may not coincide with periods of extreme volatility in national stock markets. Meanwhile, trading forex is something that is the most profitable if you do it in the short term.

In conclusion, forex trading vs stock trading has remained a persistent and popular debate between traders of all levels of experience. If you have decided which asset you would like to trade, or would like to open positons within both markets simultaneously, follow the below steps. For example, when trading Forex, most people tend to look for political news rather than news from separate companies. Every trader was very conservative about making risky trades while Brexit was still being debated, but now that it’s pretty much-guaranteed traders are a lot more open to risk. What’s more, of the few retailer traders who engage in forex trading, most struggle to turn a profit with forex.

If an active trader is not available during regular market hours to enter, exit or properly manage trades, stocks are not the best option. However, if an investor’s market strategy is to buy and hold for the long term, generating steady growth and earning dividends, stocks are a practical choice. The instrument a trader or investor selects should be based on which is the best fit of strategies, goals, and risk tolerance. Stock index e-mini futures are other popular instruments based on the underlying indexes.

To the best of our knowledge, all content is accurate as of the date posted, though offers contained herein may no longer be available. The opinions expressed are the author’s alone and have not been provided, approved, or otherwise endorsed by our partners. As per the Visual Capitalist, there are 60 major exchanges in the world with a total value of $69 trillion. The percentage of returns is potentially bigger although it may be dangerous if you take unnecessary risks. They have the best volatility, which means more accurate signals and trends.

If the EUR/USD exchange rate is 1.2, that means €1 will buy $1.20 (or, put another way, it will cost $1.20 to buy €1). You have to be a patient – In order to build a decent amount of wealth through trading, you need to wait for years. Simple Trading – You can easily invest in stocks that track the index like S&P 500 and get good returns without any hassle. Risk – Forex Market is a high leverage market which makes it very risky. Forex market is focused on eight major currencies, which can be easily monitored and tracked. Stock Market comprises of millions of public listed companies.

In addition to it, news about the company also drives the prices of the company stock up and down. Here we will discuss both these financial markets, their characteristics, their advantages and disadvantages and what makes each one of them a better investment. Keep your motivation even if you wanted to trade stocks and you can only trade forex. The amount of available capital to trade and the time of the day that you can actually trade, are usually the most important factors in order to choose which one is better for you to trade. But you shouldn’t be afraid of trading stocks because of the liquidity unless you are trading cheap penny stocks.

Learn to trade

This means that you’ll typically need to trade positions of at least $100,000 to see any type of significant profit on your forex trades. Technical analysis is a type of financial analysis that uses patterns and indicators to inform a trader when he or she should buy or sell an asset. Traders who use technical analysis to inform their trading strategy typically don’t spend a lot of time reading the news or researching a company’s business plan. Instead, they may look at candlestick charts for indicators that a stock or currency will drop or rise in price soon.